Cryptocurrency Market Update: Analysis and Insights – March 20, 2024

Cryptocurrency markets are experiencing a crash this week, and they haven’t settled yet. Bitcoin lost nearly 15%, and Ether more than 22% this week. Most of the top 20 cryptocurrencies are experiencing double-digit losses. Ripple’s XRP is down 16%, Cardano is down 22%. Meme coins DOGE and SHIB are losing a quarter of their value. Solana’s SOL is the only cryptocurrency in the green this week. SOL’s performance reminds us that there is some upside to diversification.

This is the most severe correction since January. During the post-ETF approval sell-off in January, we experienced a drawdown close to 21%. The current correction represents a monthly drawdown of 17.6% so far. We know by now that such corrections are part of Bitcoin’s DNA.

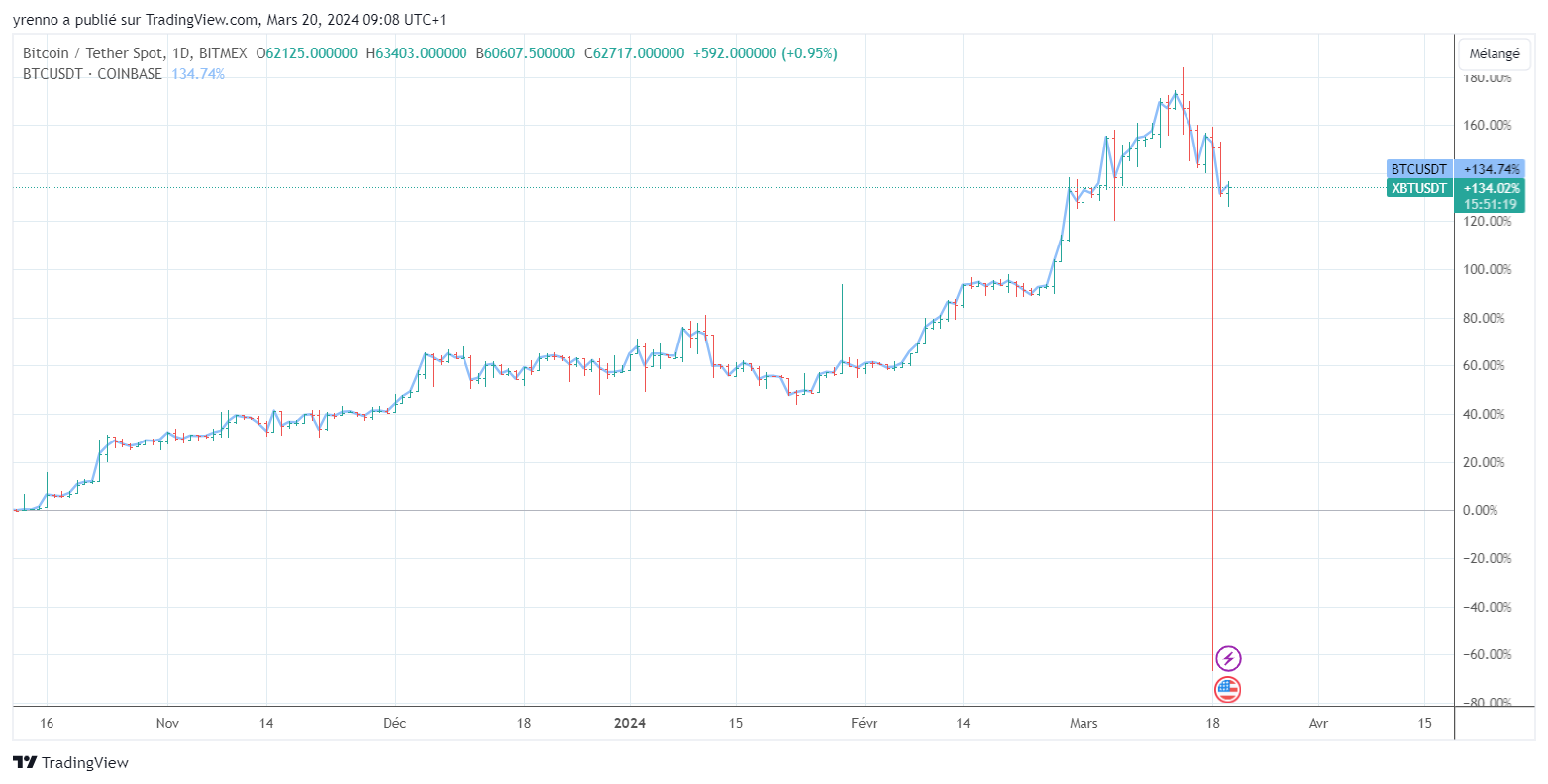

And, of course, we still have spectacular accidents happening on centralized exchanges - this is also in the cryptocurrency sector's DNA. This graph shows the price of the Bitcoin/USDT spot pair on Bitmex against the price quoted on Coinbase (in blue). The Bitcoin price on Bitmex dropped to 8,900 USDT in the span of 2 minutes, just after 10:40 PM UTC. The price rebounded completely within 10 minutes.

But this is presumably not a fat finger event. Observers noticed that a seller 'dumped more than 400 Bitcoins over 2 hours.' This right there could be the pinnacle of this week’s panic sale. This would be very difficult to achieve in traditional markets because the Best Price Execution policy prevails. If an exchange can’t fill the order at a decent level, it has to reroute it to other competitive exchanges.

Looking at the supply and demand dynamics this week:

According to Farside, the ETF net flows turned negative in the past two days. We had unwinds worth 154 million US dollars two days ago, and 326 million dollars yesterday. Grayscale’s Bitcoin fund (GBTC) has lost more than a billion US dollars in the last 2 days. It lost 642.5 million US dollars on Monday, which is its worst daily outflow since the ETF approval in January.

GBTC lost more than 40% of its Bitcoin holdings this year. As both the fund’s Bitcoin holdings and the Bitcoin price are tumbling, Grayscale’s AUM is decreasing at its fastest pace.

So from the ETF market perspective, the GBTC unwinds are accelerating. Investments in BlackRock’s IBIT and Fidelity’s FBTC are slowing down. Fidelity’s figure two days ago was particularly disappointing: only 5.9 million US dollars were invested - it was the lowest daily inflow observed this month for Fidelity.

On the supply side, we have some Bitcoin miners who are selling from their Bitcoin reserves. An analyst at CryptoQuant noted that "Bitcoin miners' reserves reached their lowest level since April 2021." The resulting growth in the circulating supply this week could have contributed to the market sell-off.

CryptoQuant’s CEO Ki Young Ju noted that these sellers are not US miners but "likely offshore or old miners." Ki Jung Yu is pointing out in these graphs that the largest US miners, namely Marathon and RIOT Holdings, are not noticeably selling but accumulating Bitcoins according to CryptoQuant’s estimates at least.

As a reminder, miners do sell their new production to cover operational costs, of course. But the rationale behind selling from their reserves has to do with their plan to upgrade hardware and maybe mitigate their inventory risk to some extent. They can mitigate their inventory risk by selling Bitcoin to buy different assets.

So, the essential question this week: Why are the ETF investments slowing down?

There are several reasons. We mentioned profit-taking already. There is clearly a resistance above the $70,000 price where investors are more reluctant to buy, and long-term holders, including some miners, were increasingly selling as the price was moving up.

- Another reason is that we now have a total AUM of more than 53 billion US dollars in Bitcoin ETFs. The market needs a breather.

- Another classic reason stems from the number of long future positions liquidated this week. The open interest on Bitcoin futures dropped by 3 billion to 32.4 billion US dollars from its peak.

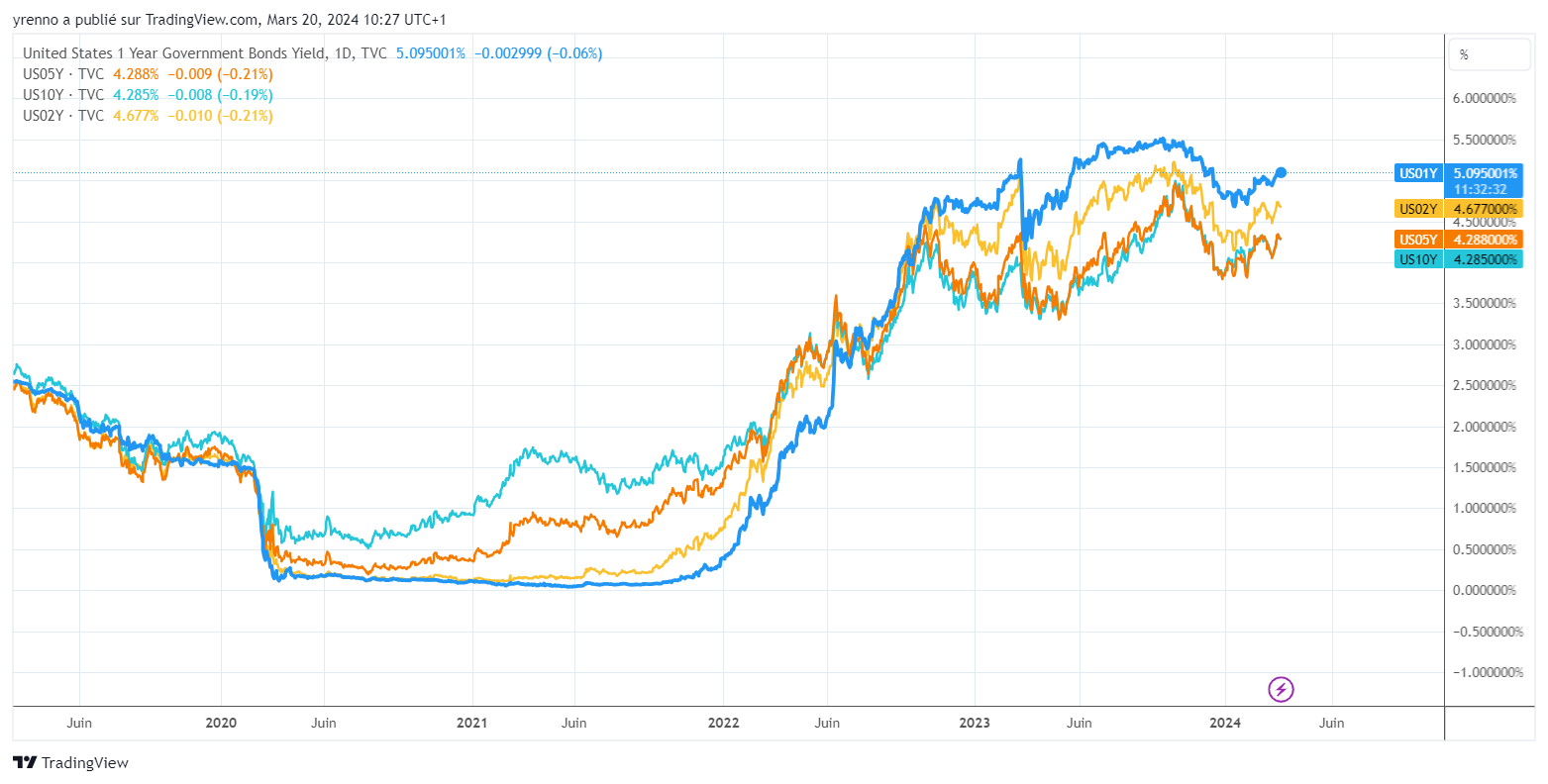

- Another essential explanation behind the market correction comes from renewed inflation worries that are slowing down institutional investment in general. We mentioned last week that the Consumer Price Index (CPI) in the US for the month of February came out on March 12th. It was a bit worse than expected at 3.2% YoY, and slightly worse than last month’s.

We’re still far from the Fed’s 2% target rate, and there is growing uncertainty over the FOMC economic projections as a result. The FOMC statement and press conference are scheduled for 6 pm and 6:30 pm tonight.

Still, overall, economists are more optimistic according to a CNBC survey released this week. The probability among the surveyed economists to see a soft landing of the economy is at its highest since July.

Economists believe that there is no rush for the Fed to cut interest rates, and the economy is doing well with the current Fed rates of 5.25 to 5.5%.

The bond markets are still expecting rate cuts within the next two years. The 2-year government bond yield is 40 basis points below the 1-year, and the 5-year is also almost 40 basis points below the 2-year.

From a crypto market perspective, the current high-rate environment could slow down a potential rally post-halving, as most investors might prefer to seek lower-risk, high-reward yield products rather than a high-risk crypto asset.

DISCLAIMER: The information contained herein is not intended as, and shall not be understood or construed as, financial advice. Wirex and any of its respective employees and affiliates do not provide financial, legal, or investment advice. The information contained herein has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial, legal, or investment advice. Content not intended for UK customers.