Grow

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

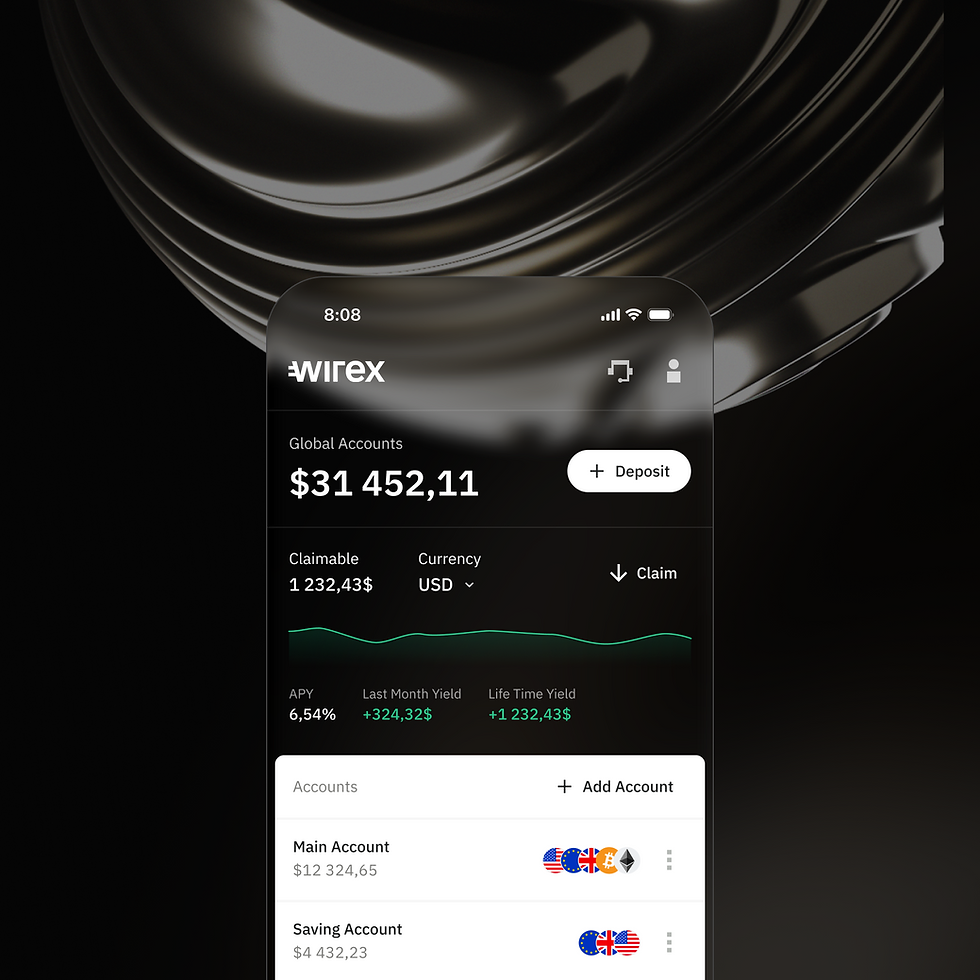

Earn Effortlessly. Stay Liquid 24/7

Traditional savings products force a choice between liquidity and returns. Wirex Yield removes that compromise

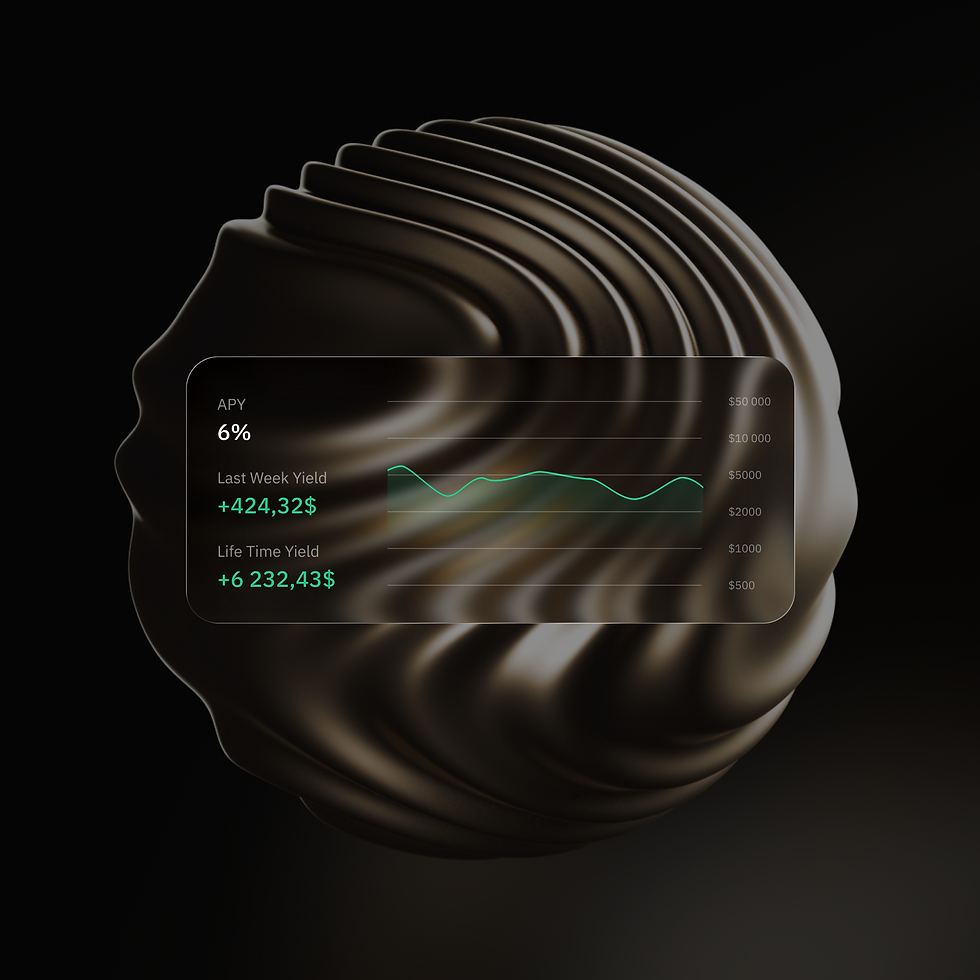

Up to 6% APY

High-performance, stablecoin-based returns

No Lock-ups

Deposit, withdraw, or spend anytime

Spend as You Earn

Instant access for global payments

Daily Compounding

Earnings calculated and added automatically

Delivering Stronger, More Consistent Returns

Morpho and AAVE hybrid model blends peer-to-pool stability with peer-to-peer precision

Up to 6% Yield on stablecoin balances

Audited, open-source protocol. Built for security and transparency

Institutional liquidity and risk controls. Optimised for corporate treasuries

Frequently Asked Questions

Everything you need to know about Business Yield

Every business on Wirex can access up to 6% yield automatically on stablecoin balances — no lockups or special tiers required. Simply hold funds in your account and start earning instantly while keeping them fully liquid.

Yes. Your balance remains fully spendable 24/7 — you can withdraw, transfer, or use it for payments through cards or banking rails while yield continues to accrue.

Wirex Yield supports leading stablecoins including USDC and EURC, ensuring seamless integration with global payment networks and on-chain liquidity.

Yes. Wirex Yield is open to companies of all sizes, from startups to global enterprises. Every verified Wirex Business client can access institutional-level yield and liquidity through a single platform.

.png)

.png)

.jpg)