Grow

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

The benefits of Wirex Credit

One ecosystem to manage, borrow and repay

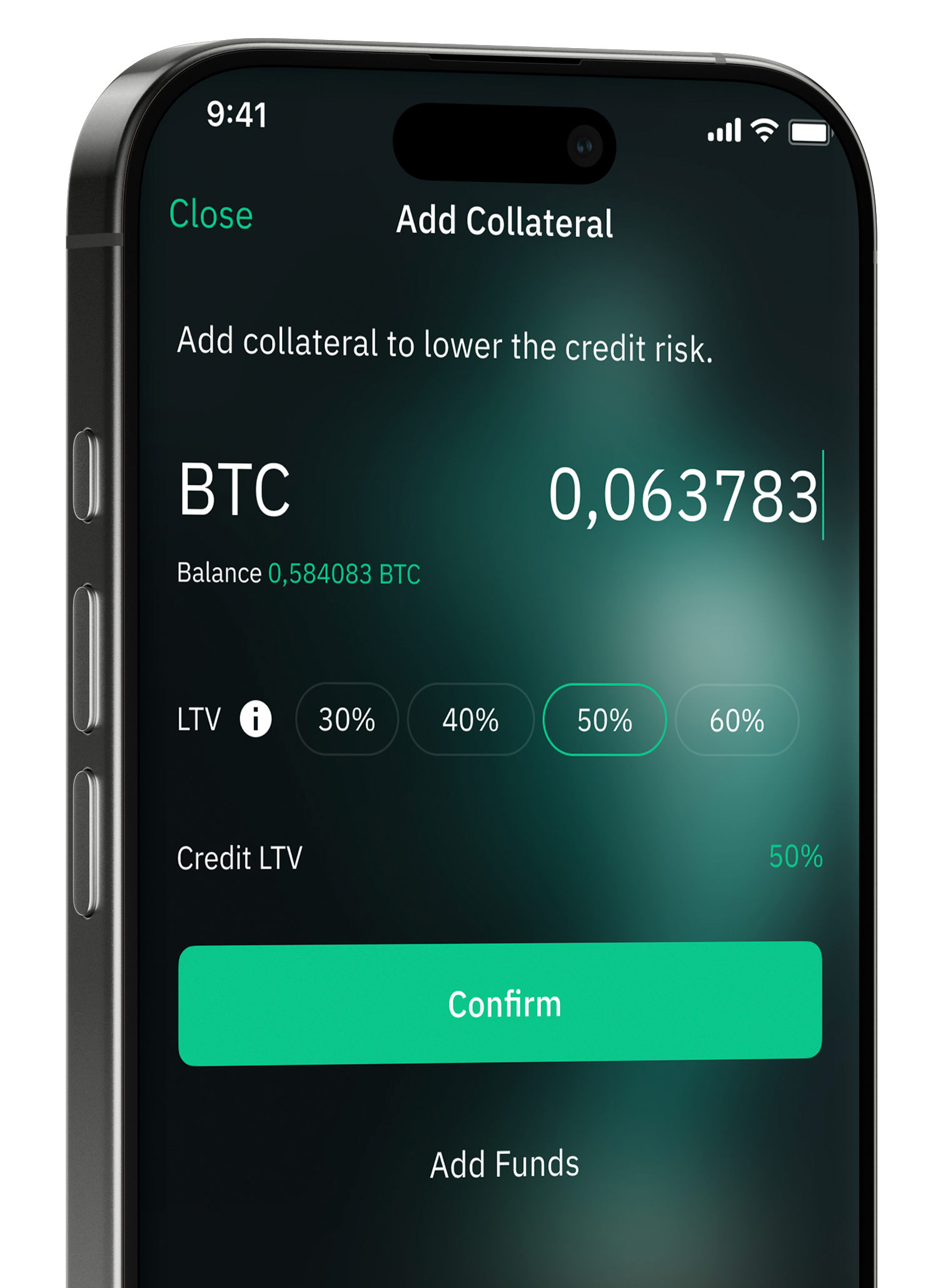

Up to 70% LTV

Access up to 70% of your crypto asset value as credit, issued in DAI or other supported stablecoins, subject to eligibility, collateral type, and market conditions

Fast Processing

Eligible users can receive credit quickly, with no credit score checks or paperwork. Availability may depend on verification, collateral sufficiency, and market conditions

Custody-Grade Security

Cryptoassets used as collateral are held using Fireblocks' infrastructure, a third-party custody solution offering institution-grade security

Transparent Costs

Interest applies only to the days your credit is active. There are no setup or maintenance fees. Early repayment is allowed at no extra cost

Proven Reliability

Wirex Credit combines institutional security with the speed of Web3 finance

Full Transparency

Track loan health and LTV in real time inside the app

Absolute Ownership

Your collateral remains fully yours; Wirex Credit never sells or rehypothecates assets

Stablecoin Power

Borrow in DAI and spent, transferred, or allocated to Multiply, DUO, or X-Accounts

Frequently Asked Questions

Everything you need to know about Wirex Credit

It’s an instant crypto-backed credit line. Use your digital assets as collateral and borrow stablecoins or fiat without selling your holdings.

Funds arrive instantly once your collateral is confirmed. No paperwork, no waiting.

Your collateral is continuously monitored. If its value drops close to the liquidation threshold, you’ll get a notification to add more or repay early.

None. Interest is transparent and calculated daily. Repay anytime — no penalties, no lock-ins.

.jpg)

.png)